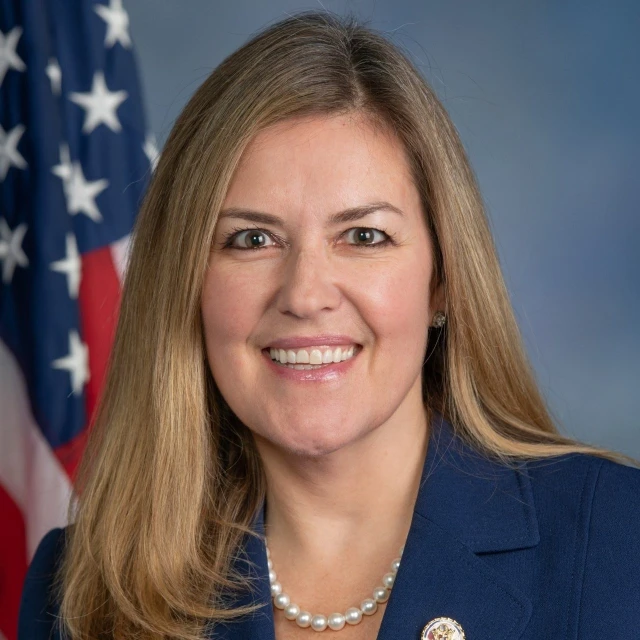

Below is a press release from Virginia Congresswoman Jennifer Wexton.

U.S. Representative Jennifer Wexton (D-VA) celebrated the one year anniversary of the Inflation Reduction Act being signed into law, highlighting the many ways the transformative law is lowering costs for Virginians, investing in clean energy and jobs, and building an economy that benefits working families.

“I’m proud to have voted to pass the groundbreaking Inflation Reduction Act which is bringing down costs, investing in a healthy planet for our future, and fixing our tax system by making the ultra-wealthy and large corporations pay their fair share,” said Congresswoman Jennifer Wexton. “Virginians are feeling the impacts of this transformative law from saving money on prescription drug costs and health care premiums to taking advantage of new clean energy and energy efficiency tax credits. I look forward to building on this important work to continue growing an economy that supports middle class families and creates good-paying jobs for the future.”

Just a year after being signed into law, the Inflation Reduction Act is having a major impact on the everyday lives of Virginians and the economy by:

- Taking on Big Pharma and following through on the promise to rein in skyrocketing prescription drug costs, which is saving more than 2,600 seniors on Medicare in Virginia-10 an average of $490 a year thanks to the new $35/month cap on out-of-pocket insulin costs.

- Putting money back in the pockets of families by lowering health care premiums, saving more than 38,000 Virginia-10 residents insured through the Affordable Care Act an average of $800 a year on health care costs.

- Delivering the largest investment in climate action in history, boosting American clean energy manufacturing to lay the groundwork necessary to reduce carbon pollution by 40% by 2030. Meanwhile, families are saving money on their energy costs thanks to all-new tax credits and rebates.

- Taking long-overdue action to modernize our tax system, improving IRS services and cutting average wait times from 27 minutes to 4 minutes. The law also cuts the deficit by cracking down on ultra-wealthy tax cheats and making big corporations pay their fair share – without raising a penny in taxes on families making less than $400,000 a year.